Latest tax rules and rates keep you ahead of changes.

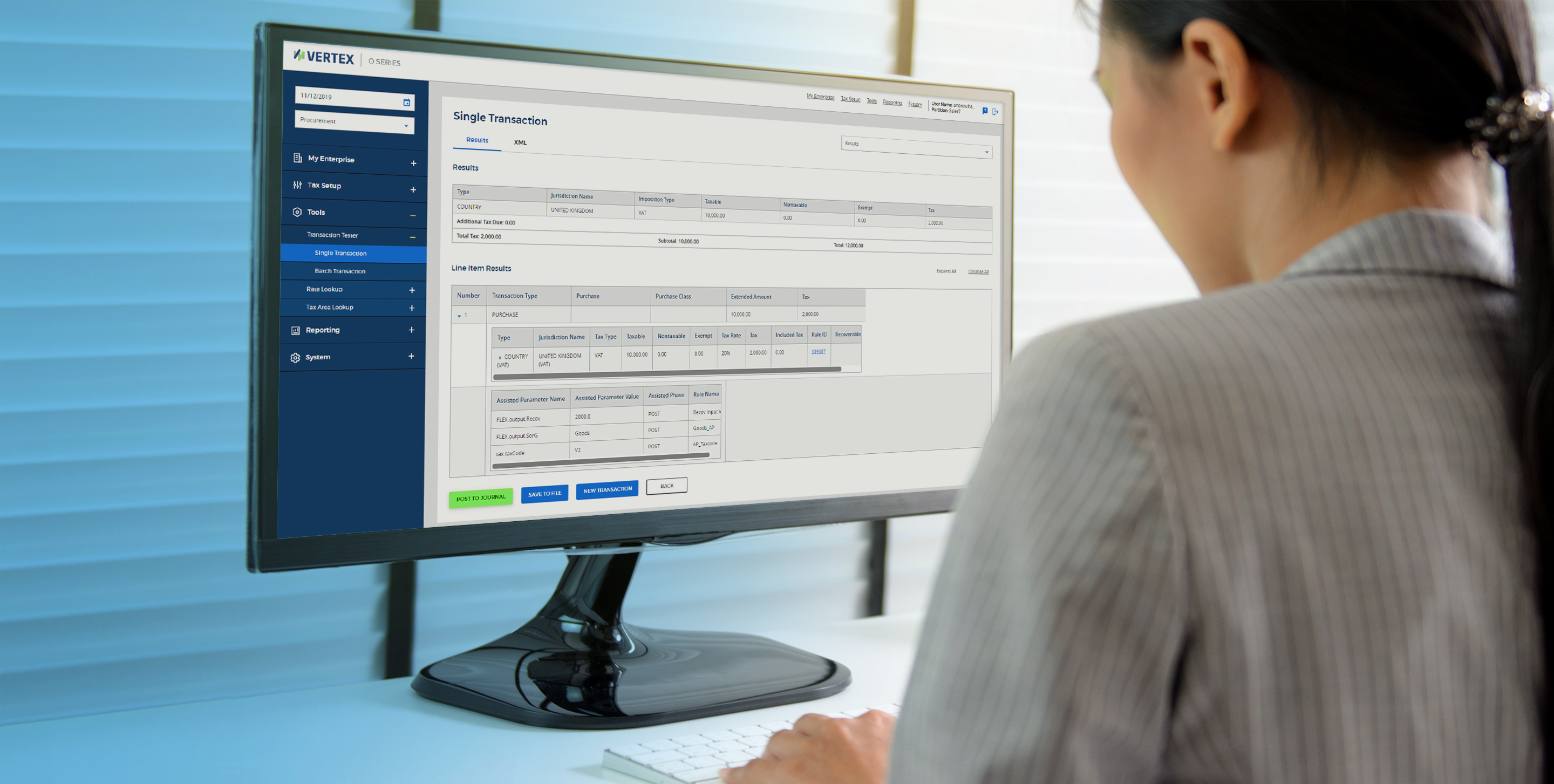

Continually updated tax rules and rates for 19,000 jurisdictions around the world keep your sales, use, and value added tax calculations accurate and reduce audit risk. Plus industry-specific content for lease tax, and communication services tax. License the content you need today, and add content as your business grows.